EBITDA vs. Revenue Multiples: Which One Should You Use to Value Your Business

To value your business, consider both EBITDA and revenue multiples based on your specific situation. Use EBITDA multiples for mature companies with stable cash flow, focusing on operational efficiency. Opt for revenue multiples when your business is in growth stages, especially in industries like tech, capturing potential over profitability. Each method has its strengths, so understanding when each is most appropriate is essential. Discover more insights into selecting the right valuation approach based on your industry and growth stage.

Key Takeaways

- Choose EBITDA multiples for mature companies with steady cash flows and significant depreciation and amortization.

- Opt for revenue multiples for high-growth startups or financially distressed companies lacking profitability but showing strong revenue growth.

- Consider industry norms and growth stage to determine the most relevant multiple for your business.

- Use EBITDA multiples to assess operational efficiency by focusing on core earnings, excluding non-operational factors.

- Revenue multiples are useful for sectors like tech and SaaS, capturing future potential and market positioning despite variable profit margins.

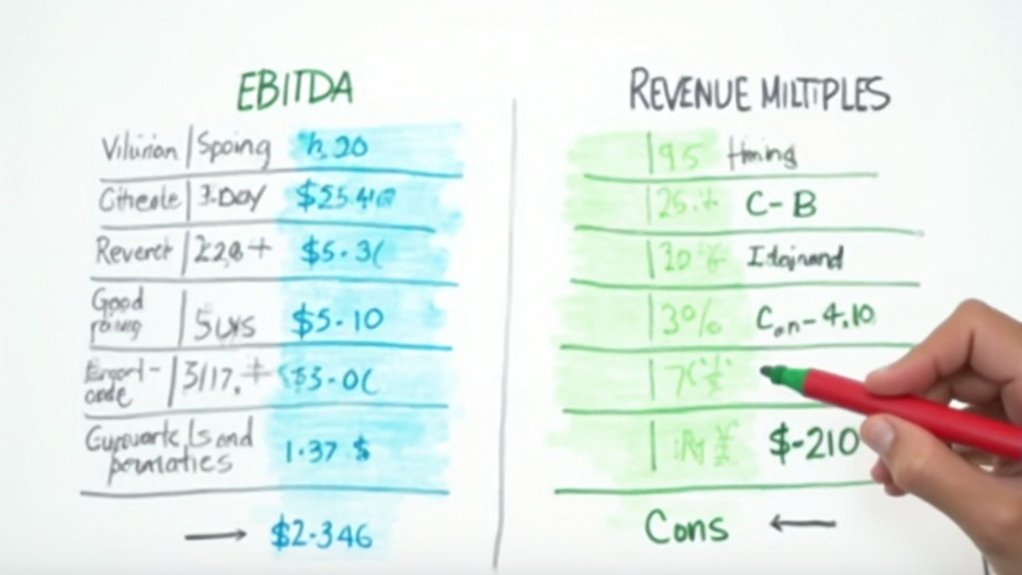

Understanding EBITDA and Revenue Multiples

When you’re diving into financial metrics, understanding EBITDA and revenue multiples is essential.

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, provides insights into a company’s operational efficiency by focusing on earnings generated from core operations. It excludes non-operational factors, giving you a clearer picture of ongoing performance.

On the other hand, revenue multiples assess how much investors are willing to pay per dollar of revenue. This metric is particularly useful for evaluating companies in industries with variable profit margins or those in early growth stages.

For small businesses, SDE often complements EBITDA by highlighting potential owner benefits and cash flow, offering a different perspective on financial performance and valuation.

Key Differences Between EBITDA and Revenue Multiples

While both EBITDA and revenue multiples serve as valuable tools for evaluating a company’s worth, they’re fundamentally different in their approach.

EBITDA multiples focus on a company’s profitability by considering earnings before interest, taxes, depreciation, and amortization. This method accounts for operational performance and financial health, providing a clearer picture of cash flow.

In contrast, revenue multiples concentrate on the top line, evaluating total sales without considering expenses or profitability.

When you use EBITDA multiples, you’re often looking at mature companies with stable cash flows. Revenue multiples, however, might be more suitable for high-growth startups yet to turn a profit.

Understanding these differences helps you choose the right metric based on your business’s financial landscape and growth stage, ensuring accurate valuation insights.

For small businesses, Sellers Discretionary Earnings (SDE) provides insight into the true earning potential by including owner-specific costs, which is critical for assessing financial health and buyer confidence.

When to Use EBITDA Multiples

Having explored the differences between EBITDA and revenue multiples, let’s focus on when using EBITDA multiples makes sense.

If you’re valuing a business in a mature industry with steady cash flow, EBITDA multiples can be a great choice. They provide insight into a company’s operational efficiency by stripping out financing, tax, and accounting decisions.

Use EBITDA multiples when you need a clearer picture of a company’s profitability and want to compare it to peers, regardless of capital structure. This approach is particularly useful for businesses with significant depreciation and amortization, such as manufacturing or telecommunications.

When to Use Revenue Multiples

Though EBITDA multiples offer valuable insights, there are scenarios where revenue multiples shine. When valuing a business, you might consider revenue multiples in the following situations:

- Early-Stage Companies: These businesses often lack profitability but demonstrate strong revenue growth. Revenue multiples can reflect potential.

- Tech and SaaS Firms: With subscription models, these companies focus on recurring revenue, making revenue multiples more relevant.

- High-Growth Sectors: In industries with rapid growth, revenue multiples can better capture future potential and market positioning.

- Financially Distressed Companies: When a company struggles with earnings, revenue multiples provide a valuation based on sales without focusing on profitability issues.

Industry Preferences for Valuation Multiples

Choosing the right valuation multiple is essential, as different industries have their own preferences tailored to their unique characteristics.

If you’re in the tech industry, you’ll often see revenue multiples used due to high growth potential and reinvestment needs, which can obscure EBITDA. On the other hand, manufacturing or traditional retail sectors might lean towards EBITDA multiples since they focus on operational efficiency and consistent cash flow.

In financial services, you’ll find a strong preference for book value multiples because they emphasize balance sheet strength.

Meanwhile, real estate companies often use cap rates, focusing on income-producing potential. Understanding these preferences helps you align your valuation strategy with industry norms, ensuring you’re evaluating your business through the lens most relevant to potential investors or buyers.

The Impact of Business Stage on Multiple Selection

While industry norms guide your choice of valuation multiples, the stage of your business also plays a significant role in this decision.

In the early stages, revenue multiples might be more suitable since your business may not yet generate significant profits. As your business matures, EBITDA multiples can provide a clearer picture of operational efficiency.

Here’s how different stages can influence your choice:

- Startup Phase: Focus on revenue multiples due to limited or negative EBITDA.

- Growth Phase: Consider both revenue and EBITDA as profitability starts to emerge.

- Mature Phase: Lean towards EBITDA multiples for a better reflection of cash flow stability.

- Decline Phase: Use EBITDA to highlight efficiency, even as revenue begins to drop.

Choosing the right multiple depends heavily on your business’s current lifecycle stage. Additionally, financial clarity is crucial to ensure potential buyers can accurately assess the business’s value.

Challenges and Limitations of EBITDA Multiples

Despite its popularity, relying on EBITDA multiples for business valuation can present several challenges and limitations. You might find that EBITDA doesn’t account for capital expenditures, which can be significant, especially in capital-intensive industries. It can also overlook changes in working capital, leading to an incomplete picture of cash flow. By not factoring in debt, EBITDA might inflate the perceived value of businesses with substantial liabilities. Additionally, EBITDA can be susceptible to accounting manipulations. Companies might adjust their earnings or amortization to present a more favorable EBITDA. This can make comparisons between companies tricky, as accounting practices vary. Finally, relying solely on EBITDA ignores the tax implications of profit, which can differ based on location and corporate structure. Therefore, you should consider these aspects when using EBITDA multiples. Proper preparation and clean financial statements are crucial in avoiding valuation errors and gaining buyer confidence.

Challenges and Limitations of Revenue Multiples

When evaluating businesses, relying on revenue multiples can also present its own challenges and limitations. While they offer a quick snapshot, they mightn’t always provide a complete picture of a business’s true value. Here’s why:

- Profitability Ignored: Revenue multiples don’t account for profitability, so a high revenue company with low profits might seem overvalued.

- Industry Variability: Different industries have different revenue models, making it hard to compare across sectors.

- Growth Potential Overlooked: They may miss the potential for future growth, focusing only on current revenue.

- Cost Structure Differences: Companies with the same revenue can have vastly different cost structures, affecting their true value.

These factors highlight the need to use revenue multiples cautiously and in conjunction with other valuation methods.

Best Practices for Choosing the Right Multiple

Understanding the challenges of revenue multiples underscores the importance of selecting the right valuation metric. To choose wisely, you should first consider your industry norms, as different sectors favor distinct multiples. For example, tech companies often lean towards revenue multiples due to rapid growth, while established firms might prefer EBITDA for its focus on profitability. Next, evaluate your business’s growth stage. Startups may benefit from revenue multiples since profitability is often secondary to growth. On the other hand, mature businesses typically find EBITDA more relevant. Additionally, ascertain your financial data is accurate and up-to-date to provide a reliable foundation for valuation. Finally, consult with financial advisors or industry experts to gain insight and confirm your chosen multiple aligns with market expectations. Many private equity firms prefer valuation multiples based on EBITDA when assessing small businesses, as these firms often prioritize strong, predictable cash flows and proven profitability.

How Market Conditions Affect Valuation Multiples

In fluctuating market conditions, valuation multiples can shift dramatically, reflecting broader economic trends and investor sentiment. You must stay vigilant as these changes directly impact your business valuation.

When markets are bullish, investors are optimistic, and valuation multiples often rise, potentially inflating your business’s value. Conversely, bearish markets can result in lower multiples, reducing perceived value.

Consider these factors:

- Economic Growth: Strong growth can lead to higher multiples as investors are willing to pay more for future earnings.

- Interest Rates: Lower rates make borrowing cheaper, boosting business investments and multiples.

- Industry Trends: Hot sectors may see higher multiples due to increased demand.

- Market Volatility: Greater uncertainty often results in lower multiples as investors become cautious.

Stay informed to navigate these shifts effectively.

Frequently Asked Questions

How Do EBITDA and Revenue Multiples Affect Investor Perceptions?

You’re influencing investor perceptions by choosing either EBITDA or revenue multiples. EBITDA highlights profitability, attracting those valuing operational efficiency. Revenue multiples can boost interest in growth potential, drawing investors focused on market capture despite current profitability.

Can External Economic Factors Influence the Choice of Multiples?

External economic factors can dramatically sway your choice of multiples. If the economy’s booming, you might lean towards more aggressive multiples. Conversely, in downturns, conservative multiples could be your safety net, helping protect against volatile conditions.

Are There Tax Implications When Choosing Between EBITDA and Revenue Multiples?

You should consider tax implications when choosing multiples. EBITDA multiples focus on operating performance, potentially revealing tax efficiencies. Revenue multiples don’t account for tax structures, possibly hiding liabilities. Always consult a tax advisor to understand specific impacts.

Do Accounting Standards Impact the Calculation of These Multiples?

When it comes to numbers, don’t throw the baby out with the bathwater. Accounting standards greatly impact how you calculate these multiples. Understanding different standards guarantees you’re comparing apples to apples, not apples to oranges.

How Do Company-Specific Risks Alter the Valuation Using These Multiples?

You’re likely wondering how company-specific risks affect your valuation. These risks can substantially alter the value by increasing uncertainty, which might lead you to apply a higher discount rate, ultimately lowering the company’s assessed worth.

Conclusion

Choosing the correct valuation metric can be essential in crafting a credible business case. Consider your company’s context, industry inclination, and market mood. While EBITDA multiples illuminate earnings efficiency, revenue multiples reveal raw revenue prowess. Each has its strengths and shortcomings, shaping their suitability. Stay savvy by scrutinizing sector standards and market movements. A strategic selection of valuation metrics guarantees an effective and eloquent evaluation, aligning with both business goals and financial frameworks.