Key Differences in How Buy-Side Vs Sell-Side Work

On the buy-side, you focus on investing capital to generate returns, analyzing fundamentals in-depth for long-term strategies. Think of asset management firms and hedge funds. On the sell-side, you’re facilitating transactions and advising clients, dealing with market conditions swiftly. This includes roles in investment banks and brokerage firms. Your success on the buy-side hinges on portfolio performance, whereas the sell-side is all about transaction volume. Curious about which path offers more?

Key Takeaways

- Buy-side focuses on investing capital for returns, while sell-side provides transaction services and market liquidity.

- Buy-side utilizes proprietary analysis for long-term investment strategies; sell-side offers short-term market-driven research.

- Buy-side career paths progress from analyst to portfolio manager; sell-side involves varied roles in a fast-paced environment.

- Buy-side impacts markets with large strategic trades; sell-side maintains market fluidity by matching buyers and sellers.

- Buy-side measures success by portfolio performance; sell-side focuses on transaction volumes and revenue generation.

Role and Function Distinctions

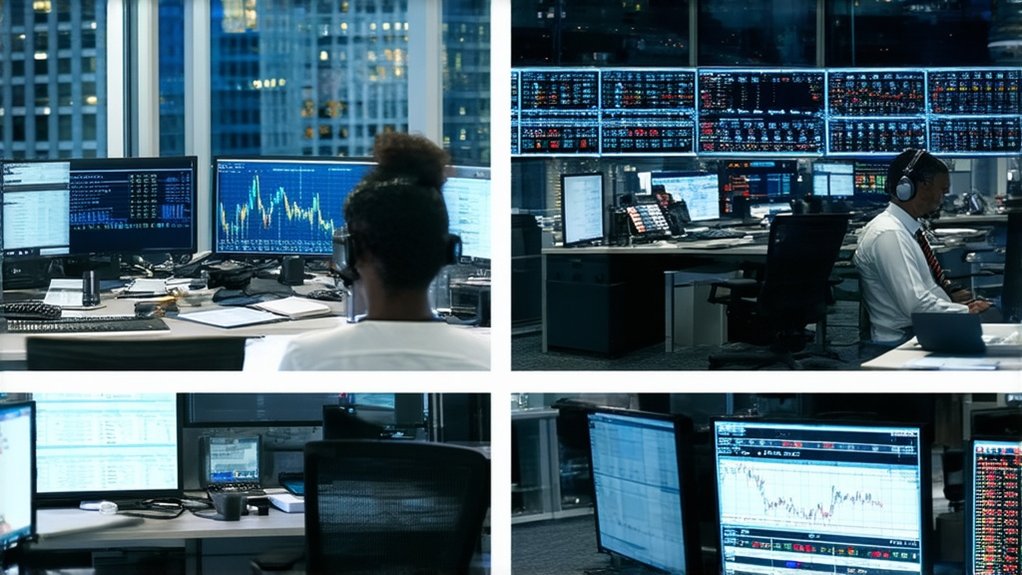

When exploring the financial markets, you’ll find distinct roles and functions between the buy-side and sell-side.

On the buy-side, you’re focused on investing capital to generate returns. You might work for asset management firms, hedge funds, or institutional investors, and your primary goal is maximizing investment performance for your clients or the fund itself.

Conversely, the sell-side involves facilitating transactions and providing services for the buy-side. If you work here, you’re likely at an investment bank or brokerage firm, where you execute trades, underwrite securities, and offer market insights.

Your role centers around supporting buy-side clients with the best execution and advisory services. Understanding these roles helps you navigate the financial ecosystem with precision and make informed career choices.

Divergence in Research and Analysis

While roles and functions clearly separate the buy-side from the sell-side, the approach to research and analysis also sets them apart.

On the buy-side, you focus on investment strategies tailored to client goals, diving deep into company fundamentals to make long-term investment decisions.

Conversely, the sell-side emphasizes generating research reports to support sales and trading activities, often seeking to influence market perceptions and drive transactions.

Your research tasks vary considerably depending on the side you’re on, impacting your daily activities and priorities.

- Buy-side analysis: In-depth, long-term focus on investment fundamentals.

- Sell-side analysis: Short-term, market-driven reports to influence trading.

- Data usage: Buy-side uses proprietary data; sell-side relies on public data.

- Audience: Buy-side serves internal teams; sell-side targets external clients.

Career Path Variations

Although both buy-side and sell-side careers are deeply rooted in finance, they offer distinct paths and opportunities for growth.

On the buy-side, you’re likely to find a more linear progression. You might start as an analyst, move up to portfolio manager, and eventually reach senior management. This path often emphasizes long-term investment strategies and client relationship management.

On the sell-side, your career might involve more varied roles and faster-paced environments. You could begin as an analyst, become an associate, and then advance to a vice president or director role.

Here, you’d focus on generating revenue through transactions, advising clients, and conducting market research. Each path has its unique challenges and rewards, so consider where your skills and interests align best.

Market Impact Dynamics

Understanding the career paths in buy-side and sell-side roles provides a foundation for exploring their market impact dynamics.

On the buy-side, you’re typically managing large trades which can influence market prices. This requires strategic planning to minimize price impact.

Sell-side professionals, however, provide liquidity and aim to match buyers with sellers efficiently, often through market-making or brokering activities.

Consider these dynamics:

- Trade Size Management: Buy-side needs to handle large orders without disrupting market equilibrium.

- Liquidity Provision: Sell-side maintains market fluidity by offering assets when needed.

- Price Impact Mitigation: Buy-side focuses on minimizing the effect of trades on market prices.

- Market Intelligence Sharing: Sell-side provides insights and recommendations to clients, influencing market sentiment.

These roles, though distinct, are essential in shaping financial markets.

Financial Outcome Metrics

Evaluating the financial outcome metrics for both buy-side and sell-side roles offers a clear view of their impact on investment strategies.

On the buy-side, your focus is on maximizing returns and managing risk for clients or your portfolio. You measure success by portfolio performance, risk-adjusted returns, and achieving specific investment goals. You’ll use metrics like alpha, beta, and Sharpe ratio to assess these outcomes.

Conversely, sell-side metrics revolve around transaction volumes and revenue generation. You aim to drive profit through trades, advisory services, and market-making activities.

Key metrics include commission fees, trading volumes, and market share. Your effectiveness is judged by how well you support buy-side clients, provide insights, and execute transactions efficiently.

Understanding these metrics helps you excel in either role.

Frequently Asked Questions

How Do Buy-Side and Sell-Side Firms Handle Regulatory Challenges?

You face regulatory challenges by implementing robust compliance programs. On the buy-side, you focus on client protection and portfolio management. On the sell-side, you emphasize market integrity and transparency. Both sides adapt to evolving regulations to guarantee compliance.

What Technological Tools Are Crucial for Buy-Side and Sell-Side Operations?

You rely on data analytics for insights, automation for efficiency, and cybersecurity for protection. You leverage advanced trading platforms for execution, risk management tools for safety, and CRM systems for client engagement. Technology streamlines your operations.

How Do Macroeconomic Factors Influence Buy-Side vs. Sell-Side Strategies?

You consider macroeconomic factors to anticipate market trends. On the buy-side, you’re focused on long-term growth, while on the sell-side, you’re adjusting strategies to seize immediate opportunities. Both require vigilance to economic shifts.

What Are Common Misconceptions About Buy-Side and Sell-Side Roles?

Many mistakenly believe both buy-side and sell-side roles revolve solely around making money. You often overlook the analytical acumen, strategic structuring, and meticulous market monitoring necessary to navigate the nuanced nuances of each side’s specific specialties.

How Do Buy-Side and Sell-Side Firms Prioritize Ethical Considerations?

You focus on maintaining transparency and avoiding conflicts of interest. Buy-side firms prioritize ethical investments, while sell-side firms guarantee fair trading practices and honest advisories. You balance profit with ethics to uphold your firm’s reputation.

Conclusion

Steering through the financial seas, you’ll find buy-side and sell-side roles charting distinct courses. As a buy-sider, you’re the treasure hunter, digging deep into research to maximize investments. On the sell-side, you’re the ship’s navigator, providing analysis to guide clients. Career paths may diverge, yet both impact market currents and influence financial outcomes. Embrace these differences, as each side complements the other, creating a dynamic dance in the vast ocean of finance.